Taxes are the legally required sum of money that the government demands be paid for any services, goods, administrations, activities, or exchanges. Taxes are the main sources of revenue for the government, which it uses to ensure the well being of the nation’s populace as a whole through policies, programs, and practises.

The right to impose taxes on income other than agricultural income is granted by Parliament by Entry 82 of List I of the Seventh Schedule of the Indian Constitution.

Therefore, the Central Government is in charge of collecting income tax because it is under the Union list. Aside from the tax on agricultural income, which is collected by the State Government, the Central Government has the power to collect taxes on income. The State Government is given the power to levy taxes on agricultural revenue under Entry 46 of List II of the Seventh Schedule of the Constitution of India.

Income Tax:

A tax on an individual’s or an organisation’s income is known as an income tax. The primary source of funding for the government’s operations is income tax revenue. The duties of the government go beyond only maintaining the peace and enforcing the law; they also include welfare and development work in the fields of health, education, and rural development, as well as funding the government’s own administration. These activities require a significant amount of public funding, which is raised via the collection of taxes.

Need A Legal Advice

The internet is not a lawyer and neither are you. Talk to a real lawyer about your legal issue

Personally Liable to Pay Income Tax:

According to the law section 2(31), a person is defined. The phrase “person” refers to

- One person.

- Undivided Hindu Family

- A business.

- A Firm.

- A group or a combination of people, whether or not they are corporations;

- A municipal government, every artificial judge, and anyone who does not fit any of the above descriptions.

An assessee is any person who has earned income or incurred losses and is required by law to pay taxes on this in a specific assessment year. Thus, there are several categories of the assessee.

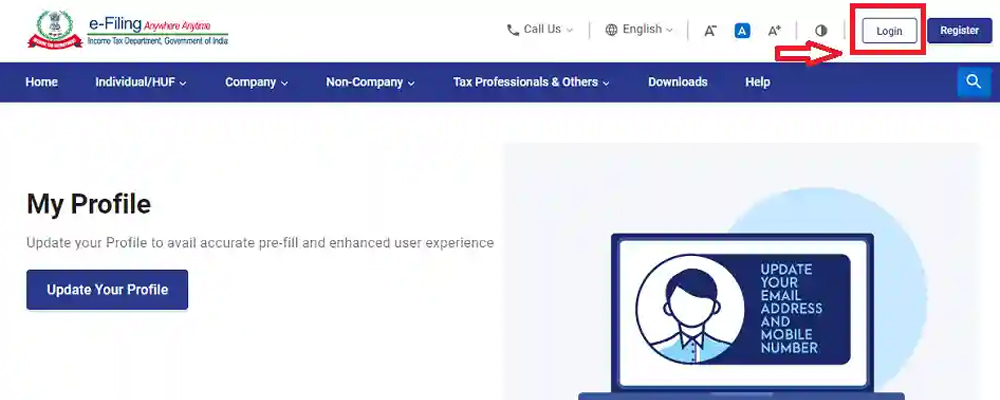

You must have registered and created an account on the government’s recently launched income tax filing website before you can submit your income tax return (ITR). Therefore, if this is your first time submitting an ITR, you must first register on the new income tax filing portal before you can actually file your report.

What Is Included in Income Tax?

The term “income” is not defined under the Income Tax Act, although section 2(24) of the Act lists several receipts that fall under the definition of income.

- Gains and profits.

- Dividends

- Donations made voluntarily to a charitable trust

- The worth of any perk or profit in place of pay.

- Any gains in the capital.

- Any lottery or crossword puzzle winnings, etc.

Requisites for Registration on Income Tax Portal: A person must have a PAN, mobile number, and email address that are all current and operational.

Steps for Online Registration:

- www.incometax.gov.in is the new income tax website.

- Click “Register” on the new site to sign up.

- Make sure the option “Taxpayer” is chosen. Type in your PAN and select Validate. You will receive a notification informing you of the error if your PAN is already registered or inactive. If you want to sign up as an “Individual taxpayer,” you must confirm. Click “Continue” after the PAN has been successfully authenticated.

- Your last name, first name, middle name, date of birth (as reported by your PAN), gender, and residence status (Resident/Non-resident) must all be entered next. Click “Continue” once these details have been entered.

- You must provide your contact information, including your primary cell phone number and email address, in the next tab. Additionally, you will need to choose whether your primary mobile number and email address are yours or belong to someone else. Also, your residential communication address must be included.

- One-time passwords (OTPs) will be given to both your email address and mobile number separately. Please be aware that these OTPs are only good for 15 minutes. After entering the OTPs, click “Continue.”

- All of the information you supplied in the prior tabs must be verified. You will have the ability to edit any errors in the details you provided in the final step if necessary. After you have checked the information, click “Confirm.”

- Now type in your selected password and the same one again for confirmation. Do keep in mind that the following should be in your password:

a) Must be between 8 and 14 characters in length.

b) Letters should be in both upper- and lowercase.

c) Must include at least one number.

d) At least one special character is required.

Additionally, you must input your own message, which may contain up to 25 characters. Every time you connect to your account on the new income tax portal, you will get this notification. This will make it easier for you to tell whether the website you are logging into is legitimate and not a scam.

Talk to a Lawyer

Talk to a Lawyer